Using the Bank Account Risk Assessment Task

Each bank account associated with a client carries its own risk. Understanding that risk is essential for effectively evaluating and managing the overall risk exposure of both the client and the institution.

The Bank Account Risk Assessment task provides the capability to evaluate the bank accounts associated with an entity. It calculates a risk score for each bank account and an overall bank account risk that is then outputted to the entity, which may then be used in calculating the overall entity risk. The following document details the user interaction and configuration of the Bank Account Risk Assessment task and provides two examples of its use.

Task Overview

The Bank Account Risk Assessment task offers a comprehensive visualization of an entity’s bank accounts and their risk assessment results.

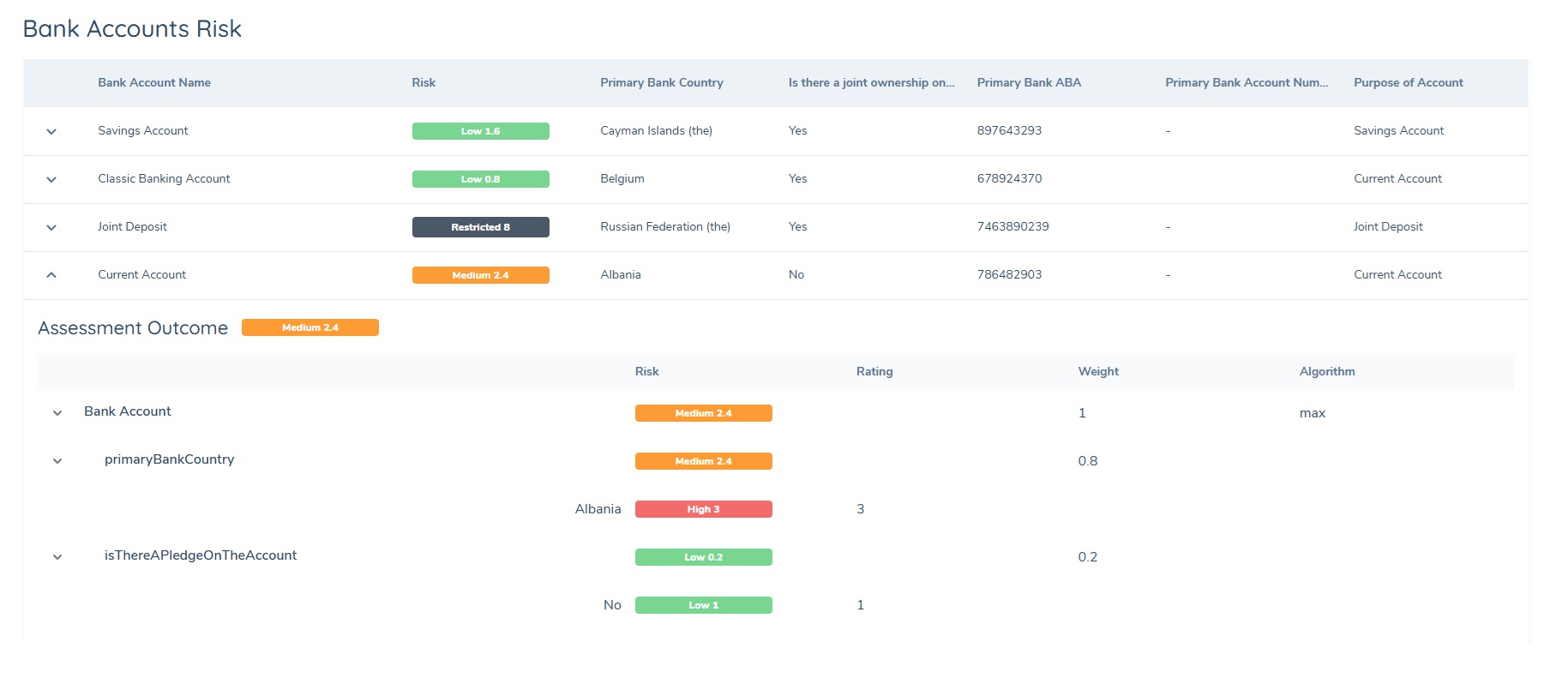

The above provides an example of a completed Bank Account Risk Assessment task. This task is a system task and will automatically run the calculations once started and when successful will automatically be completed. When completed a user may click into the task to view the results.

Each bank account is displayed as a row and may be expanded to view the assessment outcome for that bank account. The risk score and value for each bank account is displayed in the Risk column.

The expanded assessment outcome displays the following:

- Risk Factor Group. In the above this is Bank Account.

- Data base field name of each risk factor included in the risk factor group and their calculated value. Both primaryBankCountry and isThereAPledgeOnTheAccount are risk factors. The bank account ‘Current Account’ has a primaryBankCountry of Albania and the value captured against the isThereAPledgeOnTheAccount is no.

- The columns under the assessment outcome provides the rating of each value, the weight of the risk factor and the total algorithm calculation for that Risk Factor Group.

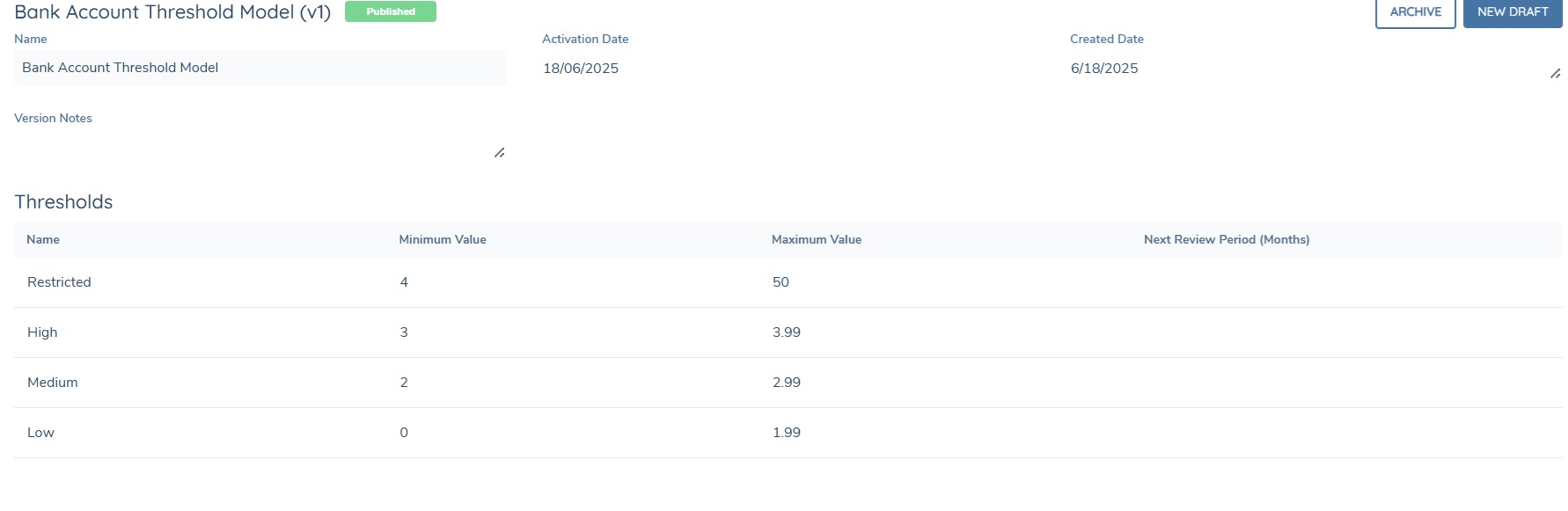

The bank account illustrated above has a risk assessment score of 2.4 which is translated to a value of medium. This translation is derived from the threshold model which states that any bank account with a risk score between 2 – 2.99 is medium.

The bank accounts included in the assessment are determined by the configuration option ‘Only Assess Accounts Created/Updated Within Journey’ which is configured at the task level in the journey scheme. When this toggle is disabled, previously verified and assessed accounts are included in the assessment but are not displayed in the task.

Bank Account Risk Calculation

Bank Account risk is calculated in accordance with the following.

1. Newly added or edited bank accounts are selected.

The Bank Account Risk Assessment task will identify the bank accounts for which the entity is an owner and that have been newly added or edited in the journey.

2. Risk assessment is run for each bank account.

For each applicable bank account the risk assessment model, as defined in the task configuration, is run. The risk assessment model is based on the following:

- A risk model: the risk factors to be evaluated.

- A configuration collection: the values and scores assigned to every possible input of the risk factors.

- A threshold model: a model that translates a numerical score to a descriptive value for example High, Medium or Low.

The model set works together to evaluate data and output a risk score. For a comprehensive explanation of risk model configuration, please refer to the risk user guide.

3. The results are combined into a single value.

In the previous step, we have produced a list of values - one numeric score for each bank account that was evaluated. The numeric score is then combined into one value. Users can configure if that combination is going to be calculated using:

- max: chooses the highest

- min: chooses the lowest

- sum: adds all values together

- avg: calculates the average ([sum of values]/[number of values])

4. A final number is produced.

This is the overall risk score of all bank accounts. This value is saved to a data base field as defined in the task configuration and outputted to the entity.

5. The number is translated into a descriptive label.

Sometimes a number isn't enough of a description, and a label is needed to describe what the risk score means. Here the bank account risk threshold model is again used to translates a numerical score to a descriptive value.